- Load the R pachages we will use.

- Read the data in the file,

drug_cos.csvinto R and assign it todrug_cos.

drug_cos <- read_csv("https://estanny.com/static/week5/drug_cos.csv")

- Use `glimpse() to get a glimpse of your data.

glimpse(drug_cos)

Rows: 104

Columns: 9

$ ticker <chr> "ZTS", "ZTS", "ZTS", "ZTS", "ZTS", "ZTS", "Z...

$ name <chr> "Zoetis Inc", "Zoetis Inc", "Zoetis Inc", "Z...

$ location <chr> "New Jersey; U.S.A", "New Jersey; U.S.A", "N...

$ ebitdamargin <dbl> 0.149, 0.217, 0.222, 0.238, 0.182, 0.335, 0....

$ grossmargin <dbl> 0.610, 0.640, 0.634, 0.641, 0.635, 0.659, 0....

$ netmargin <dbl> 0.058, 0.101, 0.111, 0.122, 0.071, 0.168, 0....

$ ros <dbl> 0.101, 0.171, 0.176, 0.195, 0.140, 0.286, 0....

$ roe <dbl> 0.069, 0.113, 0.612, 0.465, 0.285, 0.587, 0....

$ year <dbl> 2011, 2012, 2013, 2014, 2015, 2016, 2017, 20...- Use

distinctto subset distinc rows.

drug_cos %>%

distinct(year)

# A tibble: 8 x 1

year

<dbl>

1 2011

2 2012

3 2013

4 2014

5 2015

6 2016

7 2017

8 2018- Use

count()to count observations by group.

drug_cos %>%

count(year)

# A tibble: 8 x 2

year n

* <dbl> <int>

1 2011 13

2 2012 13

3 2013 13

4 2014 13

5 2015 13

6 2016 13

7 2017 13

8 2018 13drug_cos %>%

count(name)

# A tibble: 13 x 2

name n

* <chr> <int>

1 AbbVie Inc 8

2 Allergan plc 8

3 Amgen Inc 8

4 Biogen Inc 8

5 Bristol Myers Squibb Co 8

6 ELI LILLY & Co 8

7 Gilead Sciences Inc 8

8 Johnson & Johnson 8

9 Merck & Co Inc 8

10 Mylan NV 8

11 PERRIGO Co plc 8

12 Pfizer Inc 8

13 Zoetis Inc 8drug_cos %>%

count(ticker, name)

# A tibble: 13 x 3

ticker name n

<chr> <chr> <int>

1 ABBV AbbVie Inc 8

2 AGN Allergan plc 8

3 AMGN Amgen Inc 8

4 BIIB Biogen Inc 8

5 BMY Bristol Myers Squibb Co 8

6 GILD Gilead Sciences Inc 8

7 JNJ Johnson & Johnson 8

8 LLY ELI LILLY & Co 8

9 MRK Merck & Co Inc 8

10 MYL Mylan NV 8

11 PFE Pfizer Inc 8

12 PRGO PERRIGO Co plc 8

13 ZTS Zoetis Inc 8Use filter() to extract rows that meet criteria

- Extract rows in non-consecutive years

# A tibble: 26 x 9

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet~ New Jer~ 0.222 0.634 0.111 0.176

2 ZTS Zoet~ New Jer~ 0.379 0.672 0.245 0.326

3 PRGO PERR~ Ireland 0.236 0.362 0.125 0.19

4 PRGO PERR~ Ireland 0.178 0.387 0.028 0.088

5 PFE Pfiz~ New Yor~ 0.634 0.814 0.427 0.51

6 PFE Pfiz~ New Yor~ 0.34 0.79 0.208 0.221

7 MYL Myla~ United ~ 0.228 0.44 0.09 0.153

8 MYL Myla~ United ~ 0.258 0.35 0.031 0.074

9 MRK Merc~ New Jer~ 0.282 0.615 0.1 0.123

10 MRK Merc~ New Jer~ 0.313 0.681 0.147 0.206

# ... with 16 more rows, and 2 more variables: roe <dbl>, year <dbl>- Extract every other year from 2012 to 2018

# A tibble: 52 x 9

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet~ New Jer~ 0.217 0.64 0.101 0.171

2 ZTS Zoet~ New Jer~ 0.238 0.641 0.122 0.195

3 ZTS Zoet~ New Jer~ 0.335 0.659 0.168 0.286

4 ZTS Zoet~ New Jer~ 0.379 0.672 0.245 0.326

5 PRGO PERR~ Ireland 0.226 0.345 0.127 0.183

6 PRGO PERR~ Ireland 0.157 0.371 0.059 0.104

7 PRGO PERR~ Ireland -0.791 0.389 -0.76 -0.877

8 PRGO PERR~ Ireland 0.178 0.387 0.028 0.088

9 PFE Pfiz~ New Yor~ 0.447 0.82 0.267 0.307

10 PFE Pfiz~ New Yor~ 0.359 0.807 0.184 0.247

# ... with 42 more rows, and 2 more variables: roe <dbl>, year <dbl>- Extract the tickers “PFE” and “MYL”

# A tibble: 8 x 9

ticker name location ebitdamargin grossmargin netmargin ros roe

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl>

1 MYL Myla~ United ~ 0.245 0.418 0.088 0.161 0.146

2 MYL Myla~ United ~ 0.244 0.428 0.094 0.163 0.184

3 MYL Myla~ United ~ 0.228 0.44 0.09 0.153 0.209

4 MYL Myla~ United ~ 0.242 0.457 0.12 0.169 0.283

5 MYL Myla~ United ~ 0.243 0.447 0.09 0.133 0.089

6 MYL Myla~ United ~ 0.19 0.424 0.043 0.052 0.044

7 MYL Myla~ United ~ 0.272 0.402 0.058 0.121 0.054

8 MYL Myla~ United ~ 0.258 0.35 0.031 0.074 0.028

# ... with 1 more variable: year <dbl>Use select() to select, rename and reorder columns

- Select columns

ticker,nameandros

drug_cos %>%

select(ticker, name, ros)

# A tibble: 104 x 3

ticker name ros

<chr> <chr> <dbl>

1 ZTS Zoetis Inc 0.101

2 ZTS Zoetis Inc 0.171

3 ZTS Zoetis Inc 0.176

4 ZTS Zoetis Inc 0.195

5 ZTS Zoetis Inc 0.14

6 ZTS Zoetis Inc 0.286

7 ZTS Zoetis Inc 0.321

8 ZTS Zoetis Inc 0.326

9 PRGO PERRIGO Co plc 0.178

10 PRGO PERRIGO Co plc 0.183

# ... with 94 more rows- Use

selectto exclude columnsticker,nameandros

drug_cos %>%

select(ticker, -name, -ros)

# A tibble: 104 x 1

ticker

<chr>

1 ZTS

2 ZTS

3 ZTS

4 ZTS

5 ZTS

6 ZTS

7 ZTS

8 ZTS

9 PRGO

10 PRGO

# ... with 94 more rows- Rename and reorder columns with

select

start with

drug_cosTHENchange the name of

locationtoheadquarterput the columns in this order:

year,ticker,headquarter,netmargin,roe

drug_cos %>%

select(year, ticker, headquarter =location, netmargin, roe)

# A tibble: 104 x 5

year ticker headquarter netmargin roe

<dbl> <chr> <chr> <dbl> <dbl>

1 2011 ZTS New Jersey; U.S.A 0.058 0.069

2 2012 ZTS New Jersey; U.S.A 0.101 0.113

3 2013 ZTS New Jersey; U.S.A 0.111 0.612

4 2014 ZTS New Jersey; U.S.A 0.122 0.465

5 2015 ZTS New Jersey; U.S.A 0.071 0.285

6 2016 ZTS New Jersey; U.S.A 0.168 0.587

7 2017 ZTS New Jersey; U.S.A 0.163 0.488

8 2018 ZTS New Jersey; U.S.A 0.245 0.694

9 2011 PRGO Ireland 0.123 0.248

10 2012 PRGO Ireland 0.127 0.236

# ... with 94 more rowsQuestion: filter and select

Use inputs from your quiz question filter and select and replace SEE QUIZ with inputs from your quiz and replace the ??? in the code

- start with

drug_cosTHEN - extract information for the tickers MRK, MYL, PFE THEN

- select the variables

ticker,yearandebitdamargin

# A tibble: 16 x 3

ticker year ebitdamargin

<chr> <dbl> <dbl>

1 PFE 2011 0.371

2 PFE 2012 0.447

3 PFE 2013 0.634

4 PFE 2014 0.359

5 PFE 2015 0.289

6 PFE 2016 0.267

7 PFE 2017 0.353

8 PFE 2018 0.34

9 MRK 2011 0.305

10 MRK 2012 0.33

11 MRK 2013 0.282

12 MRK 2014 0.567

13 MRK 2015 0.298

14 MRK 2016 0.254

15 MRK 2017 0.278

16 MRK 2018 0.313Question: rename

- start with

drug_cosTHEN - extract information for the tickers LLY, MRK THEN

- select the variables

ticker,rosandroe. Change the name ofroetoreturn_on_equity

# A tibble: 16 x 3

ticker ros return_on_equity

<chr> <dbl> <dbl>

1 MRK 0.15 0.114

2 MRK 0.182 0.113

3 MRK 0.123 0.089

4 MRK 0.409 0.248

5 MRK 0.136 0.096

6 MRK 0.117 0.092

7 MRK 0.162 0.063

8 MRK 0.206 0.199

9 LLY 0.22 0.306

10 LLY 0.239 0.273

11 LLY 0.255 0.290

12 LLY 0.153 0.138

13 LLY 0.14 0.162

14 LLY 0.159 0.185

15 LLY 0.096 -0.015

16 LLY 0.155 0.264selectranges of columns

- by name

drug_cos %>%

select(ebitdamargin:netmargin)

# A tibble: 104 x 3

ebitdamargin grossmargin netmargin

<dbl> <dbl> <dbl>

1 0.149 0.61 0.058

2 0.217 0.64 0.101

3 0.222 0.634 0.111

4 0.238 0.641 0.122

5 0.182 0.635 0.071

6 0.335 0.659 0.168

7 0.366 0.666 0.163

8 0.379 0.672 0.245

9 0.216 0.343 0.123

10 0.226 0.345 0.127

# ... with 94 more rows- by position

drug_cos %>%

select(4:6)

# A tibble: 104 x 3

ebitdamargin grossmargin netmargin

<dbl> <dbl> <dbl>

1 0.149 0.61 0.058

2 0.217 0.64 0.101

3 0.222 0.634 0.111

4 0.238 0.641 0.122

5 0.182 0.635 0.071

6 0.335 0.659 0.168

7 0.366 0.666 0.163

8 0.379 0.672 0.245

9 0.216 0.343 0.123

10 0.226 0.345 0.127

# ... with 94 more rowsselecthelper functions

starts_with("abc")matches columns start with “abc”ends_with("abc")matches columns end with “abc”contains_with("abc")matches columns contain with “abc”

drug_cos %>%

select(ticker, contains("locat"))

# A tibble: 104 x 2

ticker location

<chr> <chr>

1 ZTS New Jersey; U.S.A

2 ZTS New Jersey; U.S.A

3 ZTS New Jersey; U.S.A

4 ZTS New Jersey; U.S.A

5 ZTS New Jersey; U.S.A

6 ZTS New Jersey; U.S.A

7 ZTS New Jersey; U.S.A

8 ZTS New Jersey; U.S.A

9 PRGO Ireland

10 PRGO Ireland

# ... with 94 more rowsdrug_cos %>%

select(ticker, starts_with("r"))

# A tibble: 104 x 3

ticker ros roe

<chr> <dbl> <dbl>

1 ZTS 0.101 0.069

2 ZTS 0.171 0.113

3 ZTS 0.176 0.612

4 ZTS 0.195 0.465

5 ZTS 0.14 0.285

6 ZTS 0.286 0.587

7 ZTS 0.321 0.488

8 ZTS 0.326 0.694

9 PRGO 0.178 0.248

10 PRGO 0.183 0.236

# ... with 94 more rowsdrug_cos %>%

select(year, ends_with("margin"))

# A tibble: 104 x 4

year ebitdamargin grossmargin netmargin

<dbl> <dbl> <dbl> <dbl>

1 2011 0.149 0.61 0.058

2 2012 0.217 0.64 0.101

3 2013 0.222 0.634 0.111

4 2014 0.238 0.641 0.122

5 2015 0.182 0.635 0.071

6 2016 0.335 0.659 0.168

7 2017 0.366 0.666 0.163

8 2018 0.379 0.672 0.245

9 2011 0.216 0.343 0.123

10 2012 0.226 0.345 0.127

# ... with 94 more rowsUse group_by to set up data for operations by group

group_by

drug_cos %>%

group_by(ticker)

# A tibble: 104 x 9

# Groups: ticker [13]

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet~ New Jer~ 0.149 0.61 0.058 0.101

2 ZTS Zoet~ New Jer~ 0.217 0.64 0.101 0.171

3 ZTS Zoet~ New Jer~ 0.222 0.634 0.111 0.176

4 ZTS Zoet~ New Jer~ 0.238 0.641 0.122 0.195

5 ZTS Zoet~ New Jer~ 0.182 0.635 0.071 0.14

6 ZTS Zoet~ New Jer~ 0.335 0.659 0.168 0.286

7 ZTS Zoet~ New Jer~ 0.366 0.666 0.163 0.321

8 ZTS Zoet~ New Jer~ 0.379 0.672 0.245 0.326

9 PRGO PERR~ Ireland 0.216 0.343 0.123 0.178

10 PRGO PERR~ Ireland 0.226 0.345 0.127 0.183

# ... with 94 more rows, and 2 more variables: roe <dbl>, year <dbl>drug_cos %>%

group_by(year)

# A tibble: 104 x 9

# Groups: year [8]

ticker name location ebitdamargin grossmargin netmargin ros

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 ZTS Zoet~ New Jer~ 0.149 0.61 0.058 0.101

2 ZTS Zoet~ New Jer~ 0.217 0.64 0.101 0.171

3 ZTS Zoet~ New Jer~ 0.222 0.634 0.111 0.176

4 ZTS Zoet~ New Jer~ 0.238 0.641 0.122 0.195

5 ZTS Zoet~ New Jer~ 0.182 0.635 0.071 0.14

6 ZTS Zoet~ New Jer~ 0.335 0.659 0.168 0.286

7 ZTS Zoet~ New Jer~ 0.366 0.666 0.163 0.321

8 ZTS Zoet~ New Jer~ 0.379 0.672 0.245 0.326

9 PRGO PERR~ Ireland 0.216 0.343 0.123 0.178

10 PRGO PERR~ Ireland 0.226 0.345 0.127 0.183

# ... with 94 more rows, and 2 more variables: roe <dbl>, year <dbl>Use summarize to calculate summary statistics

- Maximunm

roefor all companies

drug_cos %>%

summarize( max_roe = max(roe))

# A tibble: 1 x 1

max_roe

<dbl>

1 1.31- maximum

roefor eachyear

drug_cos %>%

group_by(year) %>%

summarise( max_roe = max(roe))

# A tibble: 8 x 2

year max_roe

* <dbl> <dbl>

1 2011 0.451

2 2012 0.69

3 2013 1.13

4 2014 0.828

5 2015 1.31

6 2016 1.11

7 2017 0.932

8 2018 0.694- maximum

roefor eachticker

drug_cos %>%

group_by(ticker) %>%

summarise( max_roe = max(roe))

# A tibble: 13 x 2

ticker max_roe

* <chr> <dbl>

1 ABBV 1.31

2 AGN 0.184

3 AMGN 0.585

4 BIIB 0.334

5 BMY 0.373

6 GILD 1.04

7 JNJ 0.244

8 LLY 0.306

9 MRK 0.248

10 MYL 0.283

11 PFE 0.342

12 PRGO 0.248

13 ZTS 0.694Question: summarize

Mean for year

Find the mean ros for each

yearand call the variable mean_rosExtract the mean for 2016

# A tibble: 1 x 2

year mean_ros

<dbl> <dbl>

1 2016 0.253- The mean ros for 2016 is 0.253 or 25.3

Median for year

Find the median ros for each

yearand call the variable median_rosExtract the median for 2016

# A tibble: 1 x 2

year meadian_ros

<dbl> <dbl>

1 2016 0.286- The median ros for 2016 is: 0.286 or 29%

- Pick a ratio and a year and compare to companies.

drug_cos %>%

filter(year == 2018) %>%

ggplot(aes(x = netmargin, y = reorder(name, netmargin))) +

geom_col() +

scale_x_continuous(labels = scales::percent) +

labs(title = "Comparison of net margin",

subtitle = "for drug companies during 2018",

x = NULL, y = NULL) +

theme_classic()

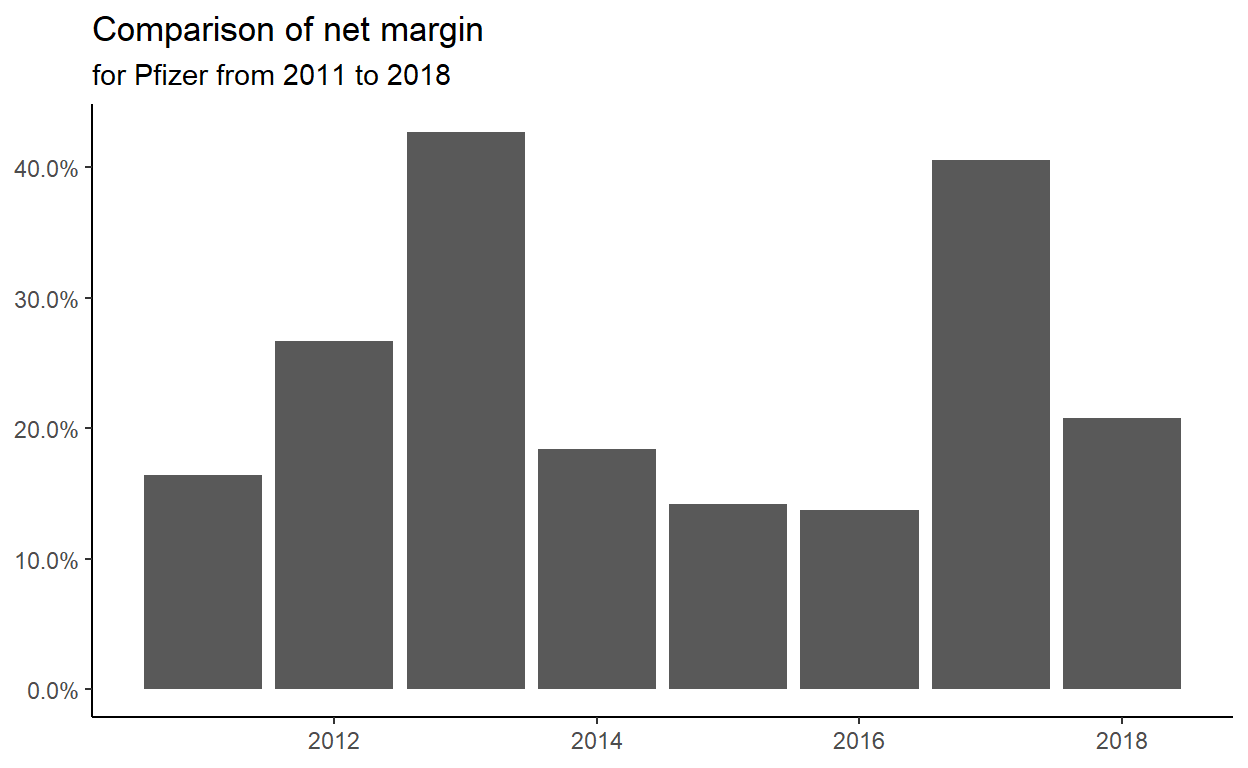

- Pick a company and a ratio and compare the ratio over time.

drug_cos %>%

filter(ticker == "PFE") %>%

ggplot(aes(x = year, y = netmargin)) +

geom_col() +

scale_y_continuous(labels = scales::percent) +

labs(title = "Comparison of net margin",

subtitle = "for Pfizer from 2011 to 2018",

x = NULL, y = NULL) +

theme_classic()

ggsave(filename = "preview.png",

path = here::here("_posts", "2021-03-09-data-manipulation"))